Create a Last Will with our simple Will template to be in charge of how your family and possessions are cared for after you pass on. Outline beneficiaries, assets, and important information.

Templates created by legal professionals

Customize your documents quickly & easily

24/7 free phone & email customer support

Trusted by 8,180 users.

Do you have a child or children? Do you have a child or children?Last Update September 2nd, 2024

Will and Testament

Fill forms in a few steps

Save, print, & download

Done in 5 minutes

Table of Contents:A Last Will and testament is an important legal document that many people write. The purpose of a Last Will and testament is to allow an individual, also known as a testator, to decide who receives their personal property after they pass away.

This means, with a Last Will, you are legally in charge of the distribution of your property after your passing.

Some alternative names for a Last Will and testament are:

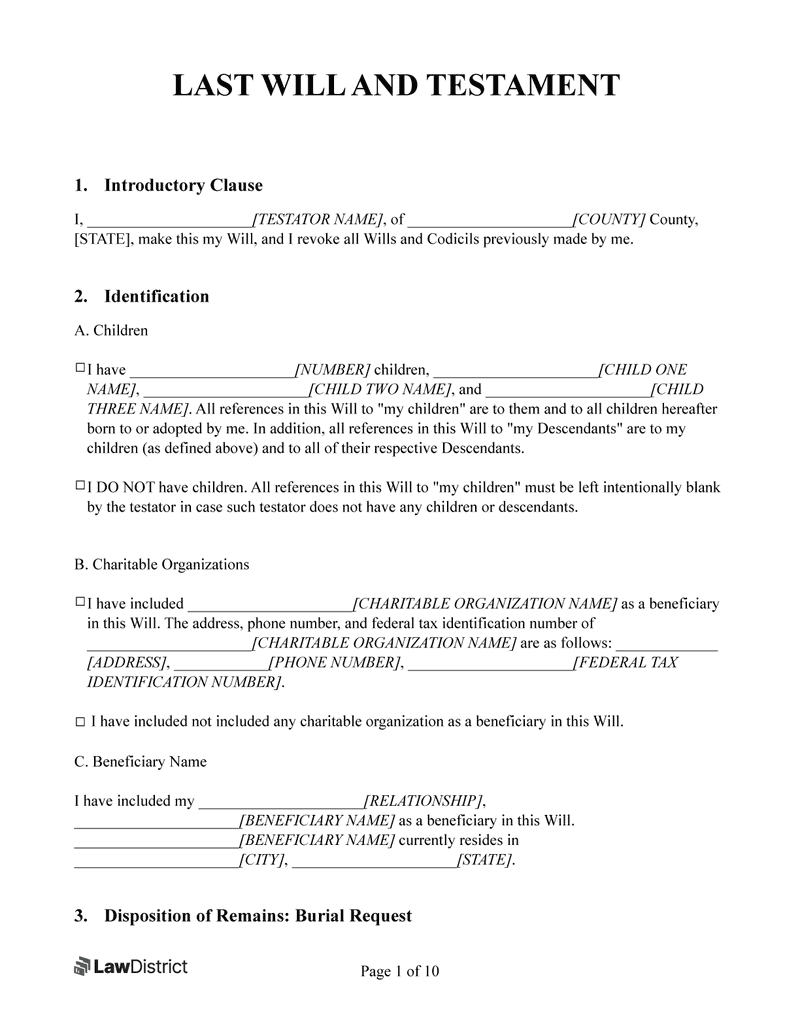

Having a look at a free Will template from LawDistrict gives you a good idea of how to make your own Will.

A Will helps people have peace of mind in their final days. There will be much less confusion and disagreement over your belongings when the time eventually comes.

Even when you know what information to specifically include, it is always a good idea to see a sample document.

You can use a Last Will and Testament sample from LawDistrict to help you create your own document.

A Will is an essential legal document for a few different reasons. While what happens to your estate and possessions after your death may not seem important now, not signing a Will has some serious consequences [1].

A Final Will has key uses that make it essential for anyone interested in passing on and protecting their belongings.

It gives you and your loved one peace of mind and security, knowing you have made the decisions for where your belongings go. This leads to fewer arguments over the ownership of your assets and property when you pass on.

Underage children are also protected when parents sign a Last Will and Testament, as you can assign them a legal guardian [2].

A Last Will and Testament is an extremely helpful legal document that just about any adult should make.

People who fall into these categories are especially in need of a Will:

A good question to ask yourself is what happens if I don’t write a Will?

Not writing a Will before you die means a court-appointed administrator decides who receives your possessions.

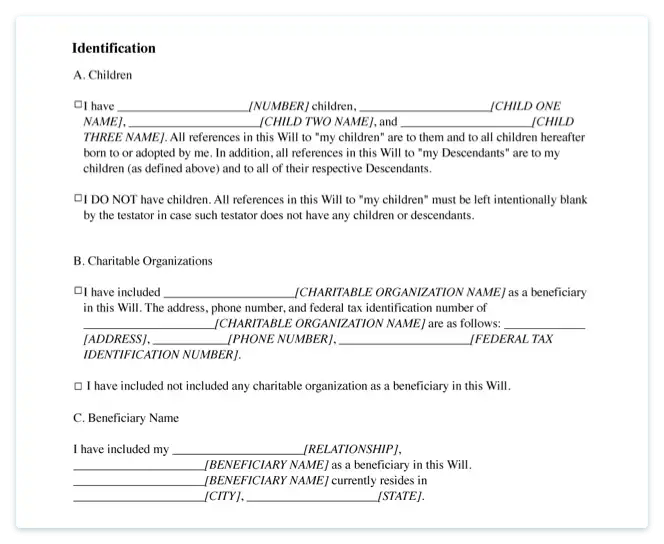

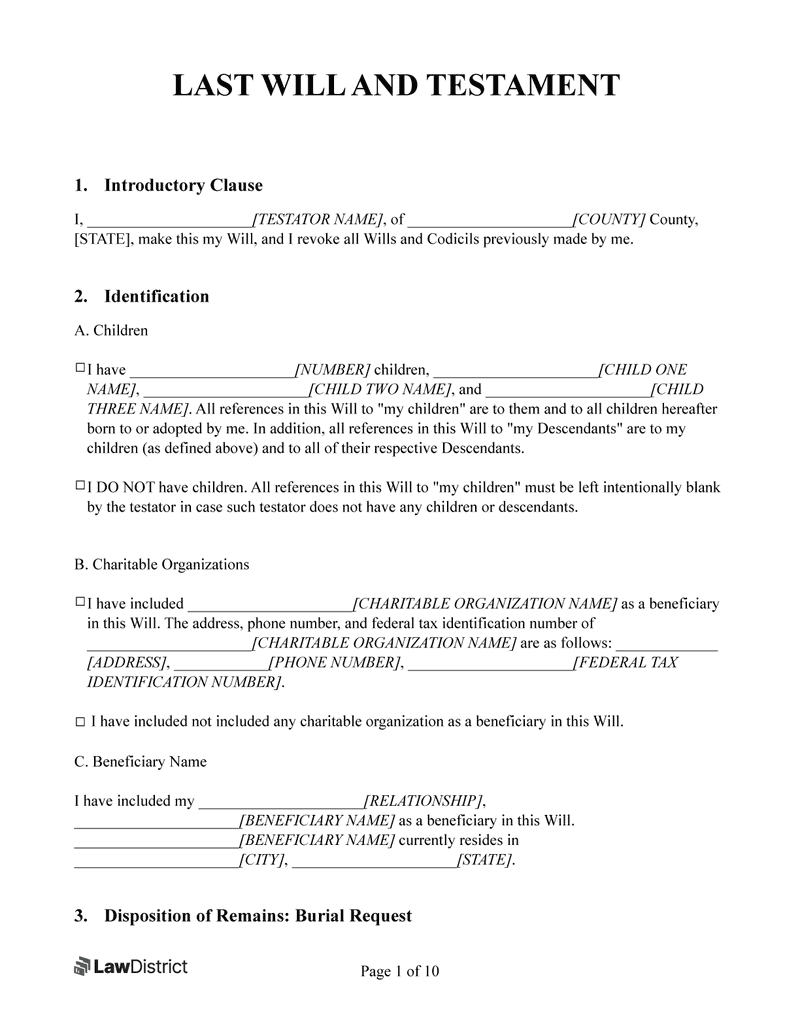

Knowing how to properly fill out a Last Will and Testament form is important. There are essential details and information that must be included.

Follow these steps to write a Last Will and testament that meets the legal criteria [3].

A testator is the person who writes the Will. If it is your Will, then fill in your first name, last name, and the county and state that you live in. This also revokes any Wills and amendments made previously.

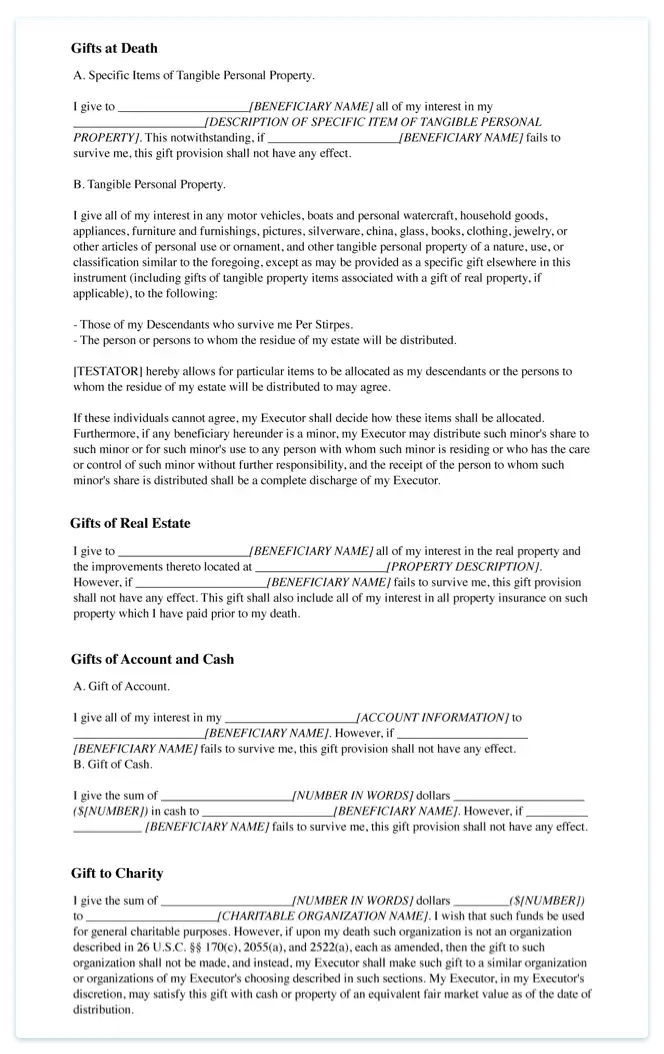

Include which people or organizations receive your possessions once your debts are settled. Your loved ones or charities are good examples of beneficiaries.

Also, include the name of your beneficiaries and fill in their information.

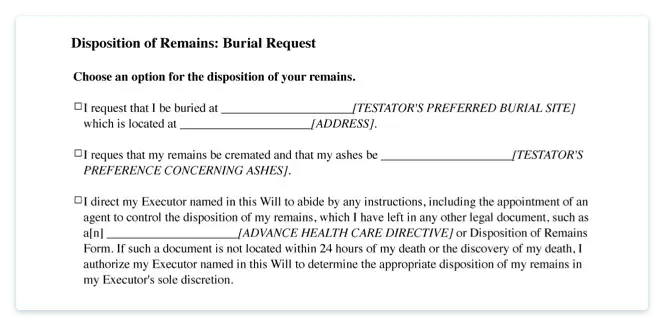

Remember to add funeral arrangements. These arrangements can include:

You can then add which specific items are given to which beneficiaries.

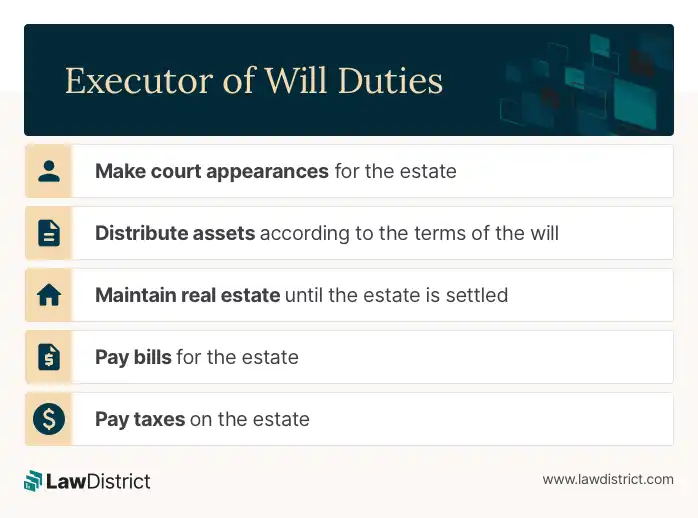

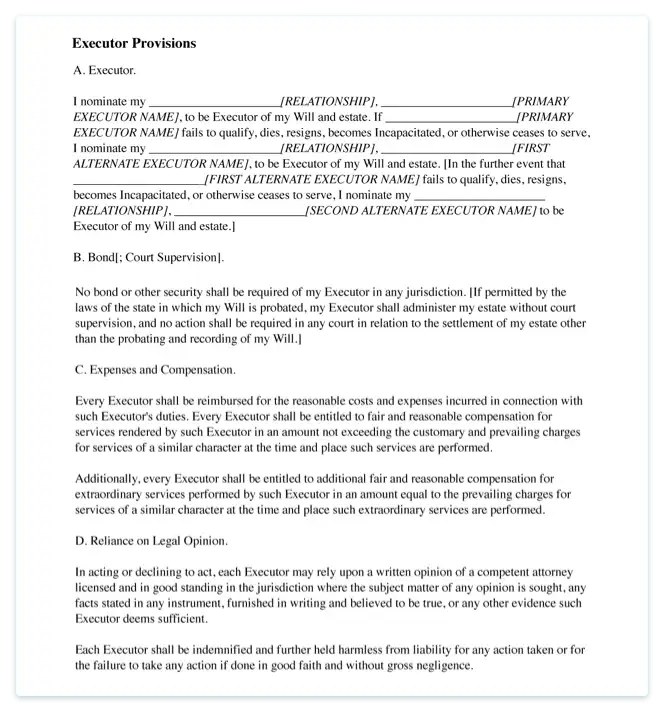

Next, include the executor. Executors make court appearances, distribute assets, and perform other duties. Many people choose a spouse or one of their children to be their executor.

Make sure to fill in your relationship with him or her and nominate an alternate Executor and second alternate Executor.

This part lists which power and authority he or she has with respect to your estate. The Executor must still distribute all property and assets to the beneficiaries.

These powers include:

The state where you reside is the state that governs your Will. This means you must fill in what state you reside in.

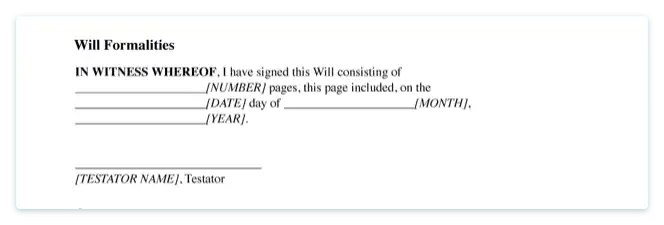

A Last Will and testament should be signed with 2 disinterested witnesses, whether it is mandatory in your state or not [4].

In this part you write the number of pages of the Will, the date and sign.

Your witnesses sign sworn statements, these include filling in which state and county the Will takes effect in and the witnesses’ names and addresses.

Finally, if you choose to or if it is required, a Notary Public swears and signs the Will.

Different states have different requirements. Most states require 2 witnesses to sign the document.

In some states, it is necessary to sign with a notary public.

Have a look at your state law regarding Last Wills and Testaments.

| State | State Law | Signing Requirement |

|---|---|---|

| Alabama | § 43-8-131 | Two (2) Witnesses |

| Alaska | § 13.12.502 | Two (2) Witnesses |

| Arizona | § 14-2502 | Two (2) Witnesses |

| Arkansas | § 28-25-102 | Two (2) Witnesses |

| California | § 6110 | Two (2) Witnesses |

| Colorado | § 15-11-502 | Two (2) Witnesses and a Notary Public |

| Connecticut | § 45a-251 | Two (2) Witnesses |

| Delaware | § 201 to 202 | Two (2) Witnesses |

| Florida | § 732.502 | Two (2) Witnesses |

| Georgia | § 18-103 | Two (2) Witnesses |

| Hawaii | § 560:2-502 | Two (2) Witnesses |

| Idaho | § 15-2-502 | Two (2) Witnesses |

| Illinois | Section 755 ILCS 5/4-3 | Two (2) Witnesses |

| Indiana | § 29-1-5-3 | Two (2) Witnesses |

| Iowa | § 633.279 | Two (2) Witnesses |

| Kansas | § 59-606 | Two (2) Witnesses |

| Kentucky | § 394.040 | Two (2) Witnesses |

| Louisiana | § Art. 1577 | Two (2) Witnesses and a Notary Public |

| Maine | § 2-502 | Two (2) Witnesses |

| Maryland | § 4-102 | Two (2) Witnesses |

| Massachusetts | § 2-502 | Two (2) Witnesses |

| Michigan | § 700-2502 | Two (2) Witnesses |

| Minnesota | § 524.2-502 | Two (2) Witnesses |

| Mississippi | § 91-5-1 | Two (2) Witnesses |

| Missouri | § § 72-2-522 | Two (2) Witnesses |

| Nebraska | § 30-2327 | Two (2) Witnesses |

| Nevada | § 133.040 | Two (2) Witnesses |

| New Hampshire | § 551 | Two (2) Witnesses |

| New Jersey | § 3B:3-2 | Two (2) Witnesses |

| New Mexico | § 45-2-502 | Two (2) Witnesses |

| New York | § 3-1.1 | Two (2) Witnesses |

| North Carolina | § 31-3.3 | Two (2) Witnesses |

| North Dakota | § 30.1-08-02. (2-502) | Two (2) Witnesses |

| Ohio | § 2107.03 | Two (2) Witnesses |

| Oklahoma | § 84-55 | Two (2) Witnesses |

| Oregon | § 112.235 | Two (2) Witnesses |

| Pennsylvania | § § 2502 | Two (2) Witnesses |

| Rhode Island | § 33-5-5 | Two (2) Witnesses |

| South Carolina | § 62-2-502 | Two (2) Witnesses |

| South Dakota | § 29A-2-502 | Two (2) Witnesses |

| Tennessee | § 32-1-104 | Two (2) Witnesses |

| Texas | § 251.051 | Two (2) Witnesses |

| Utah | § 75-2-502 | Two (2) Witnesses |

| Vermont | § 14 V.S.A. § 5 | Two (2) Witnesses |

| Virginia | § 64.2-403 | Two (2) Witnesses |

| Washington | § 11.12.020 | Two (2) Witnesses |

| Washington D.C. | § 18-103 | Two (2) Witnesses |

| West Virginia | § 41-1-3 | Two (2) Witnesses |

| Wisconsin | 853.03 | Two (2) Witnesses |

| Wyoming | § 2-6-112 | Two (2) Witnesses |

Unfortunately, in some circumstances, your will could be declared invalid by your state for a few different reasons.

If you need to make changes to your Will, it is possible to do so. You can use a “codicil”, which is an amendment to a Last Will and testament.

If you need to make any changes to your beneficiaries, assets, etc., make sure to attach a codicil to your Last Will.

A self-proving affidavit is also recommended. This is used to prove you made the changes to the document of your own free will.

Although they have similar titles, a Last Will and a Living Will have very different purposes.

Both documents deal with end-of-life issues when you are not able to communicate your preferences anymore.

| Last Will | Living Will |

|---|---|

| Assign someone to distribute your property after death | States preferred health care preferences if you cannot communicate. |

| Assigns legal guardians to take care of underage children | States-specific treatment for specific circumstances |

To put it simply, a Last Will is used to plan for what happens to you and your belongings when you eventually die.

A Living Will is to let medical staff know if you would like to receive a certain treatment or not, in case you become unable to communicate.

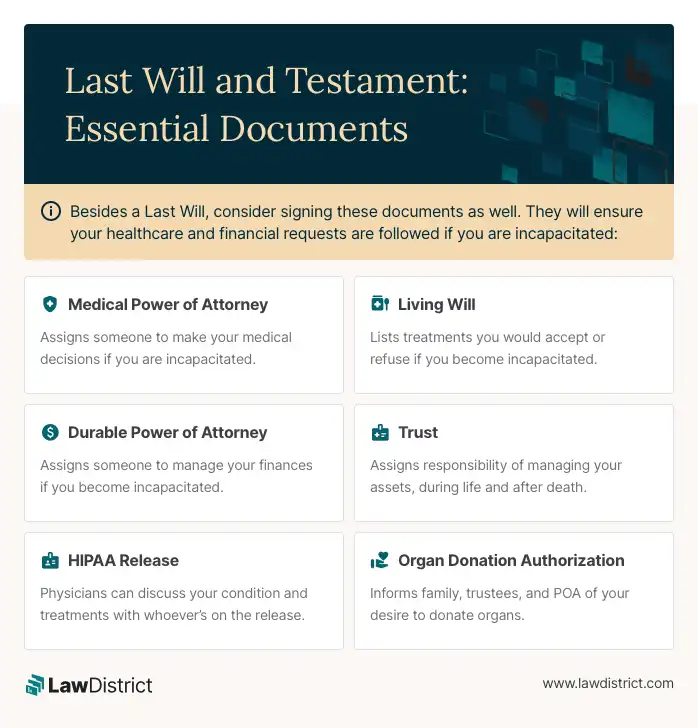

Along with a Last Will, there are other documents that are similar and may interest you.

These documents can be used in a situation when you cannot communicate your desires or want to legally distribute your property and money.

Sources:

If you remain uncertain about how to outline your Last Will and testament, keep reading and find the answers to the most common questions about Last Wills below.

When people look for legal documents, they often go to a lawyer. This is a sensible option, however, it can be very expensive and time-consuming.

LawDistrict provides a Last Will and Testament printable template that is very easy to use and understand. Easily create this legal document with our outline.

Using our template you can cut down on the excessive lawyer fees and save yourself a lot of time.

Between a Last Will and a Living Trust, there is a key similarity and a few differences.

Many people frequently confuse the two documents, which is a massive mistake. There are some important details you need to be aware of.

Both documents are used to determine who receives your possessions after you die.

However, apart from that detail, there can be some doubts concerning which document is appropriate in which situation.

Check out the table below to clarify any doubts.

A Power of Attorney and Last Will both help you when you are not able to communicate your desires.

However, it is essential to understand that you should have both documents.

A Power of Attorney makes decisions for you while you are still alive, but you are not able to communicate.

The moment you die, the Power of Attorney loses its authority.

Using a Last Will and Testament means you have the power to make decisions after you pass away.

Using this document will ensure your belongings and assets end up where you want them to. Your executor will be in charge of overseeing your assets until they are distributed.

A professional who can create a Last Will, is a lawyer. However, if a lawyer makes a Last Will for you, they could charge around $300. Depending on your estate, it could even be around $1,000.

In almost every circumstance, lawyer fees are costly. You also need to wait until the lawyer is available to make the document.

With LawDistrict’s legal documents, you can easily make a Last Will on your own.

Our easy-to-write and legally valid online will not only be a cost-effective option, but it will also save you plenty of time and energy.

Yes, it is possible to make a Joint Will. These types of Wills are created and usually signed by a married couple.

This document allows 2 or more people to list their assets and beneficiaries together on a single document.

Joint Wills often state:

It is recommended to make a joint will if you are in complete agreement with your spouse, on how your personal property and belongings will be distributed.

You are not explicitly required to file your Will. You only need to keep it in a safe place where it can be found upon your death.

However, once you pass away, your Executor will be obligated to file the document in the probate court of your county.

Depending on your state, the executor (or whoever is in possession of the Will) will have a certain amount of days to file the Will after the date of death.

Failure to file the will could result in a lawsuit by someone else involved in the testament.

You are only a few steps away from your own Last Will and Testament!

Download our professional examplesI, _________, of _________, _________ County, Alabama, make this my Last Will, and I revoke all Wills and Codicils previously made by me.

PRELIMINARY DECLARATIONSMarital Status

1. I am not currently married.

Current Children

2. I currently do not have any living children.

3. All references in this Will to "my children" are to all children hereafter born to or adopted by me.

EXECUTOR PROVISIONSDefinition

4. The Executor is defined as the fiduciary charged with administering the estate at the testator's death. Some jurisdictions use the term personal representative to refer to the estate fiduciary and some jurisdictions use the term and 'executrix'.

Nomination

5. I nominate _________ of _________, _________, to be my independent Executor of this Will.

If _________ dies, or fails to qualify, resigns, becomes incapacitated, or otherwise ceases to serve as my Executor, I nominate the survivor of _________ to be my independent Executor of this Will.

6. No bond or other security shall be required of my Executor in any jurisdiction. No action shall be required in any court in relation to the settlement of my estate other than the probating and recording of my Will and, if required by law, the return of an inventory, appraisement, and list of claims of my estate, or the filing of an affidavit in lieu of such inventory if permitted by law.

Executor Powers

7. The Executor shall, to the extent permitted by law, act independently and free from the control of any court as to my estate (and as to all the property of my estate). The Executor shall have and possess the following powers and authorities (each of which shall be exercisable at the discretion of such Executor) concerning my estate:

a. To pay my legally enforceable debts, funeral expenses, and all expenses in connection with the administration of my estate and the trusts created by my Will as soon as convenient after my death. If any of the real property devised in my Will remains subject to a mortgage at the time of my death, then I direct that the devisee taking that mortgaged property will take the property subject to that mortgage and that the devisee will not be entitled to have the mortgage paid out or resolved from the remaining assets of the residue of my estate.

b. To take all legal actions to have the probate of my Will completed as quickly and simply as possible, and as free as possible from any court supervision, under the laws of the State of Alabama.

c. Retention of Property

Except as otherwise provided in this Will, to retain any property which was owned by me at the time of my death when my Executor determines that, because of the circumstances involved, my estate would be better served by not diversifying the investment in such property.

d. Dealing in Estate Assets

Except as otherwise provided in this Will, to exchange, sell, manage, convey, or lease for cash, property, or credit, or to partition, publicly or privately, at such prices, on such terms, times, and conditions and by instruments of such character and with such covenants as my Executor deems proper, all or any part of the properties of my estate, including real property, and no vendee or lessee shall be required to look to the application of any funds paid to my Executor.

e. Borrowing and Managing Assets

Except as otherwise provided in this Will, to borrow money from any source (including any Executor) and to mortgage, pledge, or in any other manner encumber all or any part of the properties of my estate as may be advisable in the judgment of my Executor for the advantageous administration of my estate. The Executor shall also have the power to maintain, convert, purchase and liquidate investments and securities. Further, the Executor shall have the power to vote stock or exercise any option concerning any investments or securities without liability for loss.

Except as otherwise provided in this Will, to open or close bank accounts.

g. Business Operations

Except as otherwise provided in this Will, to maintain, continue, dissolve, change or sell any business which is part of my estate, or to purchase any business if deemed necessary or beneficial to my estate by my Executor.

h. Closely Held Businesses

Except as otherwise provided in this Will, to continue any business (whether a proprietorship, corporation, partnership, limited partnership, or other entity) which I own or in which I am financially interested at the time of my death for such time as my Executor deems it to be in the best interests of my estate; to employ in the conduct of any such business such properties of my estate as my Executor deems proper; to borrow money for use in any such business alone or with other persons financially interested in such business, and to secure such loan or loans by mortgage, pledge, or any other manner of encumbrance of not only my interest in such business but also such other properties of my estate as my Executor deems proper; to organize, either alone or jointly with others, new corporations, partnerships, limited partnerships, or other entities; and generally to exercise concerning the continuance, management, sale, or liquidation of any business which I own or in which I am financially interested at the time of my death or of any new business or business interest, all the powers I could have exercised during my lifetime.

i. Distribution to Beneficiaries

Except as otherwise provided in this Will, to make, in the discretion of my Executor, any distribution required or permitted to be made to any beneficiary under this Will.

j. Legal Affairs

Except as otherwise provided in this Will, to claim, maintain, settle, sue, quit, or otherwise deal with any lawsuits against my estate. Further, the Executor shall also have the power to seek legal representation, accountant consultancy, or any other professional aid necessary for the benefit of the estate.

k. Distributions in Kind

Except as otherwise provided in this Will, to make divisions, partitions, or distributions in money or in kind, or partly in each, whenever required or permitted to divide, partition, or distribute all or any part of my estate and, in making any such divisions, partitions, or distributions, the judgment of my Executor in the selection and valuation of the assets to be so divided, partitioned, or distributed shall be binding and conclusive. Further, my Executor shall not be liable for any differing tax consequences for the beneficiaries of my estate. Lastly, my Executor shall be authorized to make distributions from my estate on a non-pro-rata basis.

Except as otherwise provided in this Will, to invest and reinvest the properties of my estate in any kind of property whatsoever, real or personal, whether or not productive of income, and such investments and reinvestments may be made without regard to the proportion that such property or property of a similar character held may bear to my entire estate if my Executor determines that, because of the circumstances involved, my estate would be better served by not diversifying such investment or reinvestments.

m. Dealing with Interested Parties

Except as otherwise provided in this Will, to enter into any transaction on behalf of my estate (including loans to beneficiaries for adequate security and adequate interest) despite the fact that another party to any such transaction may be:

(i) a trust of which any Executor under this Will is also a trustee;

(ii) an estate of which any Executor under this Will is also an executor, personal representative, or administrator, including my estate;

(iii) a business or trust controlled by any Executor under this Will or of which any such Executor, or any director, officer, or employee of any such corporate Executor is also a director, officer, or employee; or

(iv) any beneficiary or Executor under this Will acting individually.

n. Delegation and Agents

Except as otherwise provided in this Will, to employ attorneys, accountants, investment managers, specialists, and such other agents as my Executor shall deem necessary or desirable; to have the authority to nominate an investment manager or managers to manage all or any part of the assets of my estate and to delegate to said manager investment discretion and such nomination shall include the power to acquire and dispose of such assets; and to charge the compensation of such attorneys, accountants, investment advisors, investment managers, specialists, and other agents and any other expenses against my estate.

o. Payment of Debts

Except as otherwise provided in this Will, to use the cash and any of the securities or other property owned by me to satisfy any loans or other debts for which my estate is liable or to continue all or any portion of such loans or debts.

p. Storing Personal Property

Except as otherwise provided in this Will, to store personal property given to a person who is a minor or who is incapacitated for later distribution to such person.

q. Digital Assets

Except as otherwise provided in this Will, to access, utilize, manage, close, control, cancel, deactivate, or delete any Digital Accounts and Digital Assets in which I had a right or interest at my death. This authorization is intended to be construed to be lawful consent under the Electronic Communications Privacy Act of 1986, as amended; the Computer Fraud and Abuse Act of 1986, as amended; and any other applicable federal or state data privacy law or criminal law.

Digital Asset means an electronic record in which I had a right or interest at death and may include data, files, documents, audio, video, images, sounds, social media content, social networking content, apps, codes, credit card points, travel-related miles and points, computer source codes, computer programs, software, software licenses, databases, or the like, which are created, generated, or stored by electronic means.

r. Distributions to Minor or Incapacitated Beneficiaries

Except as otherwise provided in this Will, to make, in the discretion of my Executor, any distribution required or permitted to be made to any beneficiary under this Will in any of the following ways when such beneficiary is a minor or is incapacitated:

(i) to such beneficiary directly;

(ii) to the guardian or conservator of such beneficiary's person or property;

(iii) by utilizing the same, directly and without the interposition of any guardian or conservator, for the health, support, maintenance, or education of such beneficiary;

(iv) to a person or financial institution serving as custodian for such beneficiary under a Uniform Gifts to Minors Act or a Uniform Transfers to Minors Act of any state;

(v) by reimbursing the person who is actually taking care of such beneficiary (even though such person is not the legal guardian or conservator) for expenditures made by such person for the benefit of such beneficiary;

(vi) by managing such distribution as a separate fund on the beneficiary's behalf and the written receipts of the persons receiving such distributions shall be full acquittances to my Executor.

s. Except as otherwise provided in this Will, to be my Trustee and hold in trust the share of any minor beneficiary, to carry out any act to keep such share invested, pay the income or capital as my Executor considers advisable to maintain and educate such minor beneficiary until the beneficiary is legally an adult.

In the alternative, the Executor must carry out the acts stated above prior to such beneficiary becoming a legal adult, to pay or transfer the share to any parent or guardian of such beneficiary, subject to the same conditions. If the parent or guardian receives such payment or transfer, then my Executor shall be discharged.

Statutory and Common-Law Powers

8. In addition to the powers granted above to the Executor, the Executor shall have and possess all powers and authorities conferred by statute or common law in any jurisdiction in which such Executor may act, except for any instance in which such powers and authorities may conflict with the express provisions of this Will, in which case the express provisions of this Will shall control.

The above authority and powers granted to my Executor are in addition to any powers and elective rights conferred by state or federal law or by other provision of this Will and may be exercised as often as required and without application to or approval by any court.

DISPOSITION OF ESTATEDistribution of Residue

9. A beneficiary shall survive me for at least thirty (30) days to have the right to receive any gift or property under this Will. The beneficiaries will receive and share such residue in equal shares, including property and assets that have not been bequeathed or that are not required to pay any debt, expenses associated with this Will, taxes, funeral expenses, or any other administrative expense resulting from my Will. All property given under this Will to my beneficiaries is subject to any encumbrances or liens attached to the property.

10. I instruct my Executor to distribute the residue of my estate in the following manner ("Share Allocations"):

a. The recipient _________ of _________, _________, shall receive all of the residue of my estate for their exclusive use and property.

11. However, if an appointed beneficiary dies before having a right to receive the whole of their share of the residue of my estate, then such share or the remaining amount of that share will be divided between the remaining beneficiaries proportionately, in accordance with the above-stated Share Allocations.

Wipeout Provision

12. If all my appointed beneficiaries die before I do or if I am not survived for at least thirty (30) days, I instruct my Executor to divide the residue of my estate into one hundred (100) equal shares. Further, my Executor shall pay and transfer such shares as follows:

a. 100 shares of the residue of my estate shall be divided equally amongst my parents and siblings, or their survivors, for their exclusive use and property. If these beneficiaries die before they have a right to receive their share of my estate, and such beneficiaries have survivors, then they shall have a right to be distributed their share of my estate.

TESTAMENTARY TRUSTTestamentary Trust For Minor Beneficiaries

13. I intend to create a testamentary trust (the "Testamentary Trust") for every minor appointed in this Will as my beneficiary. Further, I name my Executor(s) as trustee (the "Trustee") of any Testamentary Trusts created under this Will. All bequeathed, transferred, or gifted assets given to a minor beneficiary under this Will are to be held in a separate trust until the beneficiary reaches the designated age. All property given by me to a minor beneficiary under this Will shall be managed by my Executor(s) until that minor beneficiary reaches the age of majority.

Trust Administration

14. I instruct the Trustee to manage the Testamentary Trust in the manner that follows:

a. The Trustee shall manage all assets and property for the benefit of the minor until such minor reaches the age that I have established above for final distribution;

b. When the minor reaches the age that I have established above for final distribution, any remaining property and assets in the trust shall be immediately transferred to the minor beneficiary; and

c. Until the minor beneficiary reaches the age that I have established above for final distribution, my Trustee shall keep all trust assets invested. Further, my Trustee shall pay the whole or such part of the net income derived from those assets and any amount out of the capital that my Trustee may deem necessary to support, maintain, educate or benefit the minor beneficiary.

15. The Trustee shall have the discretion to use trust funds in any investment or to buy property. In using discretion, the Trustee shall always act with the care, skill, and diligence expected of a prudent person acting in a similar capacity.

Trust Termination

16. The Testamentary Trust shall terminate in any of the following events: